Dividend Reinvestment Plans, commonly referred to as DRIPs, are investment programs that enable shareholders to automatically reinvest their cash dividends into additional shares of the company’s stock instead of receiving dividend payments in cash. This approach is particularly beneficial for long-term investors seeking to accumulate shares over time while avoiding transaction costs. Companies or brokerage firms typically administer DRIPs, and they frequently offer advantages such as discounted share prices or commission-free purchases.

These features make DRIPs an effective tool for investors pursuing gradual wealth accumulation. DRIPs operate on the principle of compound growth, whereby investment returns generate additional returns. When investors reinvest dividends, they increase their ownership stake in a company, which can result in larger dividend payments in subsequent periods as their share count increases.

This strategy supports a buy-and-hold investment approach, emphasizing long-term capital appreciation over short-term profits. Numerous established companies, particularly in utilities and consumer goods sectors, offer DRIPs to strengthen shareholder loyalty and maintain a consistent investor base.

The Benefits of Reinvesting Dividends

Reinvesting dividends through DRIPs offers several compelling advantages that can significantly enhance an investor’s portfolio over time. One of the most notable benefits is the potential for accelerated growth. When dividends are reinvested, they contribute to the purchase of additional shares, which can lead to an exponential increase in total returns.

For instance, if an investor holds 100 shares of a company that pays a $1 dividend per share, reinvesting that dividend allows the investor to acquire more shares, thereby increasing future dividend payments and capital appreciation. Another significant benefit of DRIPs is the dollar-cost averaging effect they provide. By automatically reinvesting dividends at regular intervals, investors can purchase shares regardless of market conditions.

This means that during market downturns, dividends will buy more shares when prices are lower, while fewer shares will be purchased when prices are high. Over time, this strategy can lead to a lower average cost per share, which can enhance overall returns. Additionally, many companies offer DRIPs with no transaction fees, allowing investors to maximize their investment without incurring additional costs.

Choosing the Right Stocks for DRIPs

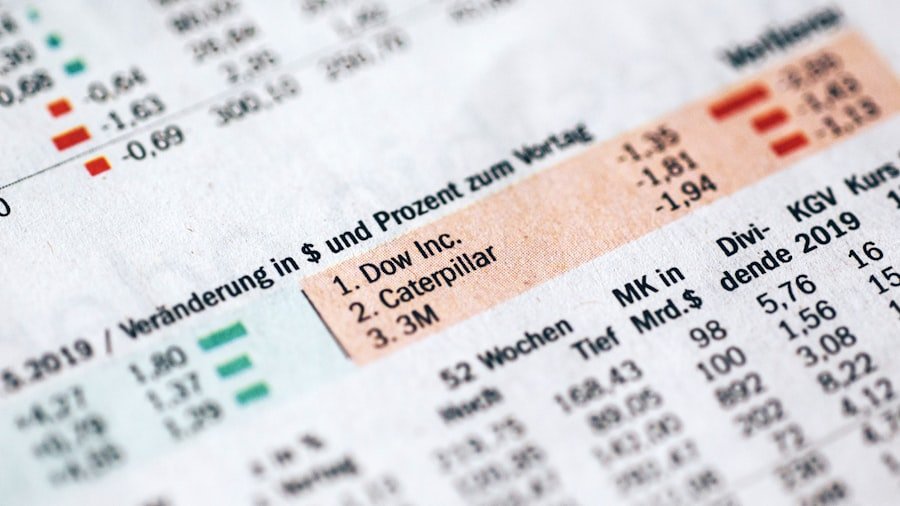

Selecting the right stocks for a Dividend Reinvestment Plan is crucial for maximizing the benefits of this investment strategy. Investors should look for companies with a strong history of paying and increasing dividends consistently over time. Blue-chip stocks, which are shares in large, well-established companies known for their reliability and stability, often make excellent candidates for DRIPs.

These companies typically have robust business models and generate steady cash flow, allowing them to return capital to shareholders through dividends. Moreover, it is essential to consider the dividend yield and payout ratio when evaluating potential stocks for a DRIP. A higher dividend yield indicates a more substantial return on investment relative to the stock price, while a lower payout ratio suggests that the company retains enough earnings to reinvest in growth opportunities.

For example, a company with a 4% dividend yield and a payout ratio of 40% may be more sustainable than one with a 6% yield and an 80% payout ratio, as the latter may struggle to maintain its dividend during economic downturns. Conducting thorough research and analysis on a company’s financial health and growth prospects is vital for making informed decisions about which stocks to include in a DRIP portfolio.

How to Enroll in a Dividend Reinvestment Plan

Enrolling in a Dividend Reinvestment Plan is generally a straightforward process that can be accomplished through various channels. Many companies offer direct enrollment options on their websites, allowing investors to sign up for DRIPs without going through a broker. This direct approach often provides additional benefits such as lower fees or discounts on share purchases.

Investors typically need to provide personal information, including their Social Security number and bank account details for dividend deposits. For those who prefer using brokerage accounts, enrolling in a DRIP can also be done through their platforms. Most major brokerage firms allow investors to set up automatic reinvestment of dividends for stocks held within their accounts.

This option provides flexibility and convenience, as investors can manage multiple investments from one location. It is essential to review the specific terms and conditions associated with each plan, as some companies may have minimum investment requirements or restrictions on how dividends are reinvested.

Maximizing the Power of Compounding

| Metric | Without Dividend Reinvestment Plan (DRIP) | With Dividend Reinvestment Plan (DRIP) | Impact on Total Portfolio Growth |

|---|---|---|---|

| Initial Investment | 10,000 | 10,000 | Same starting point |

| Annual Dividend Yield | 3% | 3% | Dividends reinvested vs. taken as cash |

| Dividend Payout | 300 | 300 | Same dividend amount generated |

| Shares Owned After 1 Year | 100 | 103 | 3% increase in shares due to reinvestment |

| Portfolio Value After 5 Years | 11,600 | 13,400 | 15.5% higher with DRIP |

| Compound Annual Growth Rate (CAGR) | 3.1% | 5.7% | Nearly double growth rate with DRIP |

| Total Dividends Reinvested | 0 | 1,200 | Additional capital added to portfolio |

| Tax Implications | Dividends taxed as income | Dividends taxed as income, but growth deferred | Potential tax efficiency varies |

The true power of Dividend Reinvestment Plans lies in their ability to harness the effects of compounding over time. Compounding occurs when earnings generated by an investment are reinvested to generate additional earnings. In the context of DRIPs, this means that not only do dividends contribute to purchasing more shares, but those additional shares will also generate dividends in subsequent periods.

This cycle creates a snowball effect that can significantly enhance an investor’s wealth over time. To maximize the benefits of compounding through DRIPs, investors should adopt a long-term perspective and remain committed to their investment strategy even during market fluctuations. For example, consider an investor who begins with an initial investment of $10,000 in a stock with a 5% annual dividend yield and reinvests all dividends over 30 years.

Assuming an average annual growth rate of 7% for the stock price and consistent dividend payments, this initial investment could grow substantially due to the compounding effect. The longer an investor remains in the market and continues to reinvest dividends, the more pronounced the compounding effect becomes.

Tax Implications of Dividend Reinvestment Plans

While Dividend Reinvestment Plans offer numerous advantages, it is essential for investors to understand the tax implications associated with reinvesting dividends. In many jurisdictions, dividends are considered taxable income in the year they are received, regardless of whether they are reinvested or taken as cash. This means that even if an investor chooses to reinvest their dividends through a DRIP, they may still owe taxes on those dividends based on their income tax bracket.

Additionally, when shares purchased through a DRIP are eventually sold, investors may face capital gains taxes on any appreciation in value since the time of purchase. It is crucial for investors to keep accurate records of their purchases and sales to calculate capital gains accurately. Some companies provide detailed statements that outline the cost basis for shares acquired through DRIPs, which can simplify tax reporting.

Understanding these tax implications is vital for effective financial planning and ensuring compliance with tax regulations.

Monitoring and Managing Your DRIP Portfolio

Once enrolled in a Dividend Reinvestment Plan, ongoing monitoring and management of the portfolio become essential components of successful investing. Investors should regularly review their holdings to assess whether the companies continue to meet their investment criteria and whether they are still aligned with their financial goals. This includes evaluating factors such as dividend growth rates, payout ratios, and overall company performance.

In addition to performance monitoring, diversification is another critical aspect of managing a DRIP portfolio. While concentrating investments in high-quality dividend-paying stocks can be beneficial, it is also important to spread risk across different sectors and industries. This approach helps mitigate potential losses from any single investment while still allowing for growth through reinvested dividends.

Investors should periodically rebalance their portfolios to ensure they maintain an appropriate level of diversification while capitalizing on opportunities presented by market fluctuations.

Alternatives to Dividend Reinvestment Plans for Portfolio Growth

While Dividend Reinvestment Plans offer unique advantages for long-term investors seeking growth through compounding dividends, there are alternative strategies that can also contribute to portfolio growth. One such alternative is investing in exchange-traded funds (ETFs) or mutual funds that focus on dividend-paying stocks. These funds provide instant diversification by pooling investments from multiple companies while still offering exposure to dividend income.

Another option is pursuing growth stocks that may not pay dividends but have significant potential for capital appreciation. Growth stocks typically reinvest earnings back into the business rather than distributing them as dividends, which can lead to substantial increases in stock prices over time. Investors willing to take on more risk may find that focusing on growth stocks aligns better with their financial objectives.

Real estate investment trusts (REITs) also present an alternative avenue for generating income and portfolio growth. REITs are companies that own or finance income-producing real estate and are required by law to distribute at least 90% of their taxable income as dividends to shareholders. This structure often results in attractive yields while providing exposure to real estate markets without requiring direct property ownership.

In conclusion, while Dividend Reinvestment Plans offer numerous benefits for long-term investors seeking wealth accumulation through compounding dividends, it is essential to consider various strategies and alternatives based on individual financial goals and risk tolerance. Each approach has its unique advantages and challenges that should be carefully evaluated before making investment decisions.

FAQs

What is a Dividend Reinvestment Plan (DRIP)?

A Dividend Reinvestment Plan (DRIP) is a program offered by companies that allows investors to automatically reinvest their cash dividends into additional shares of the company’s stock, often without paying brokerage fees.

How do Dividend Reinvestment Plans affect total portfolio growth?

DRIPs can enhance total portfolio growth by compounding returns over time. Reinvested dividends purchase more shares, which in turn generate their own dividends, leading to exponential growth in the portfolio’s value.

Are there any fees associated with Dividend Reinvestment Plans?

Many DRIPs allow investors to reinvest dividends without paying commissions or fees. However, some plans may have minimal administrative fees, so it is important to review the specific terms of each plan.

Can Dividend Reinvestment Plans be used with all stocks?

Not all stocks offer DRIPs. Typically, DRIPs are available for dividend-paying companies that provide this option directly or through a transfer agent. Investors should check if a company offers a DRIP before investing.

Do Dividend Reinvestment Plans affect taxes?

Dividends reinvested through a DRIP are still considered taxable income in the year they are received, even though the investor does not receive the cash. Investors must report these dividends on their tax returns.

Is Dividend Reinvestment suitable for all investors?

DRIPs are generally beneficial for long-term investors seeking to grow their portfolios through compounding. However, investors who need regular income or prefer to diversify may choose to receive dividends in cash instead.

How does compounding work with Dividend Reinvestment Plans?

Compounding occurs when dividends are reinvested to buy more shares, which then generate additional dividends. Over time, this cycle increases the number of shares owned and the total value of the investment.

Can Dividend Reinvestment Plans help during market downturns?

Yes, DRIPs allow investors to buy more shares when prices are lower during market downturns, potentially lowering the average cost per share and enhancing long-term returns.

How do I enroll in a Dividend Reinvestment Plan?

Enrollment procedures vary by company but typically involve contacting the company’s investor relations department or transfer agent. Some brokerage firms also offer DRIP enrollment for stocks held in their accounts.

Are there any risks associated with Dividend Reinvestment Plans?

Risks include lack of diversification if too much is reinvested in a single stock, potential tax liabilities on dividends, and the possibility that the stock price may decline, affecting the value of reinvested shares.