Central Bank Digital Currencies (CBDCs) represent a significant evolution in the landscape of monetary systems, merging traditional banking principles with the technological advancements of the digital age. As central banks around the world explore the potential of CBDCs, they aim to create a digital form of fiat currency that is issued and regulated by a nation’s central bank. Unlike cryptocurrencies, which operate on decentralized networks and are often subject to high volatility, CBDCs are designed to maintain the stability and trust associated with government-backed currencies.

This initiative is not merely a response to the rise of private digital currencies like Bitcoin or stablecoins but also a proactive measure to enhance the efficiency of payment systems, improve financial inclusion, and adapt to the changing dynamics of consumer behavior in an increasingly digital economy. The exploration of CBDCs has gained momentum in recent years, with countries such as China, Sweden, and the Bahamas leading the charge in pilot programs and research initiatives. The People’s Bank of China, for instance, has been testing its digital yuan in various cities, aiming to streamline transactions and reduce reliance on cash.

Similarly, Sweden’s Riksbank has been investigating the e-krona as a means to counteract declining cash usage. These developments highlight a global trend towards digitization in finance, where central banks are not only considering the implications for monetary policy but also the broader economic landscape. As CBDCs continue to evolve, understanding their implications for consumers becomes paramount.

Key Takeaways

- Central Bank Digital Currencies (CBDCs) are digital forms of a country’s fiat currency issued and regulated by the central bank.

- Consumers can benefit from CBDCs through increased financial inclusion, lower transaction costs, and enhanced payment efficiency, but they also face risks such as privacy concerns and potential cyber threats.

- Consumer adoption and usage of CBDCs will depend on factors such as ease of use, security, and trust in the central bank’s management of the currency.

- Consumer protection and privacy concerns surrounding CBDCs include issues related to data security, surveillance, and potential misuse of personal information.

- CBDCs have the potential to improve financial inclusion and access to banking services for underserved populations, but regulatory oversight and a clear framework are essential to ensure consumer protection and market stability.

Understanding the Benefits and Risks for Consumers

Instantaneous Transactions and Reduced Costs

One of the most significant advantages of CBDCs is the potential for instantaneous transactions. Traditional banking systems often involve delays due to intermediaries, especially in cross-border payments. With CBDCs, transactions can be executed in real-time, reducing waiting times and enhancing user experience. Furthermore, CBDCs can lower transaction costs by eliminating fees associated with intermediaries, making financial services more accessible to a broader audience.

Risks and Concerns

However, alongside these benefits lie inherent risks that consumers must navigate. One major concern is the potential for increased surveillance and loss of privacy. Since CBDCs are issued and monitored by central banks, every transaction could be tracked, raising questions about data security and individual privacy rights.

Cyber Threats and Systemic Risks

Additionally, there is the risk of cyber threats; as digital currencies become more prevalent, they may become attractive targets for hackers. The centralization of CBDCs could also lead to systemic risks if not managed properly, as any technical failures or breaches could have widespread implications for the economy.

Consumer Adoption and Usage of Central Bank Digital Currencies

Consumer adoption of CBDCs will largely depend on their perceived utility and ease of use. For many individuals, the transition from traditional banking methods to a digital currency may seem daunting. However, as digital literacy increases and consumers become more accustomed to using mobile payment platforms and digital wallets, the acceptance of CBDCs could grow significantly.

Central banks will need to invest in education and outreach programs to inform consumers about the benefits and functionalities of CBDCs, ensuring that they feel comfortable navigating this new financial landscape. Moreover, the design of CBDCs will play a crucial role in their adoption. User-friendly interfaces that mimic existing digital payment systems can facilitate smoother transitions for consumers.

For instance, integrating CBDCs into popular mobile payment applications could encourage usage among tech-savvy individuals who are already familiar with digital transactions. Additionally, incentives such as lower transaction fees or rewards for using CBDCs could further drive consumer interest and engagement. Ultimately, successful adoption will hinge on creating a seamless experience that resonates with consumers’ needs and preferences.

Consumer Protection and Privacy Concerns

| Category | Metrics |

|---|---|

| Data Breaches | Number of reported data breaches |

| Privacy Policies | Percentage of websites with clear privacy policies |

| Consumer Complaints | Number of consumer complaints related to privacy violations |

| Regulatory Actions | Number of regulatory actions taken against companies for privacy violations |

As with any financial innovation, consumer protection is a critical consideration in the rollout of CBDCs. Central banks must establish robust frameworks to safeguard consumers against fraud, unauthorized transactions, and other potential risks associated with digital currencies. This includes implementing strong security measures such as encryption and multi-factor authentication to protect users’ accounts and personal information.

Furthermore, clear guidelines regarding liability in cases of fraud or technical failures must be established to ensure that consumers feel secure in their transactions. Privacy concerns are particularly salient in discussions surrounding CBDCs. The ability of central banks to monitor transactions raises questions about how personal data will be handled and protected.

Consumers may fear that their spending habits could be scrutinized or that their financial information could be vulnerable to breaches. To address these concerns, central banks must strike a balance between ensuring transparency for regulatory purposes and protecting individual privacy rights. This could involve adopting privacy-enhancing technologies that allow for anonymous transactions while still enabling necessary oversight.

Impact on Financial Inclusion and Access to Banking Services

One of the most promising aspects of CBDCs is their potential to enhance financial inclusion, particularly for unbanked and underbanked populations. In many regions, access to traditional banking services is limited due to geographical barriers or high costs associated with maintaining bank accounts. CBDCs can provide an alternative means for individuals to engage in financial transactions without needing a traditional bank account.

By leveraging mobile technology, central banks can facilitate access to digital currencies through smartphones or other devices, allowing individuals to participate in the economy more easily. Moreover, CBDCs can empower marginalized communities by providing them with tools for savings, payments, and investments that were previously inaccessible. For example, individuals in rural areas may find it easier to conduct transactions digitally rather than traveling long distances to reach a bank branch.

Additionally, CBDCs can help reduce transaction costs associated with remittances, which are often a lifeline for families in developing countries. By streamlining these processes, CBDCs can contribute to greater economic stability and growth within underserved communities.

Regulatory Framework and Oversight of Central Bank Digital Currencies

Establishing Guidelines for CBDCs

Central banks must collaborate with governments and regulatory bodies to establish guidelines that govern the issuance, distribution, and usage of digital currencies. This includes defining the legal status of CBDCs, ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, and addressing potential risks associated with cybersecurity.

Maintaining Consumer Trust and Confidence

Ongoing oversight will be essential to maintain consumer trust and confidence in CBDCs. Regulatory bodies must monitor the performance of digital currencies in real-time to identify any emerging risks or challenges promptly. This proactive approach will help mitigate potential issues before they escalate into larger problems that could undermine the stability of the financial system.

Engaging with Stakeholders

Additionally, engaging with stakeholders—including consumers, businesses, and technology providers—will be crucial in shaping effective regulations that reflect the needs and concerns of all parties involved.

Potential Challenges and Opportunities for Consumer Market Entry

While the introduction of CBDCs presents numerous opportunities for innovation within the consumer market, it also poses several challenges that must be addressed. One significant challenge is competition with existing financial institutions and payment systems. Traditional banks may view CBDCs as a threat to their business models, leading to resistance against their adoption.

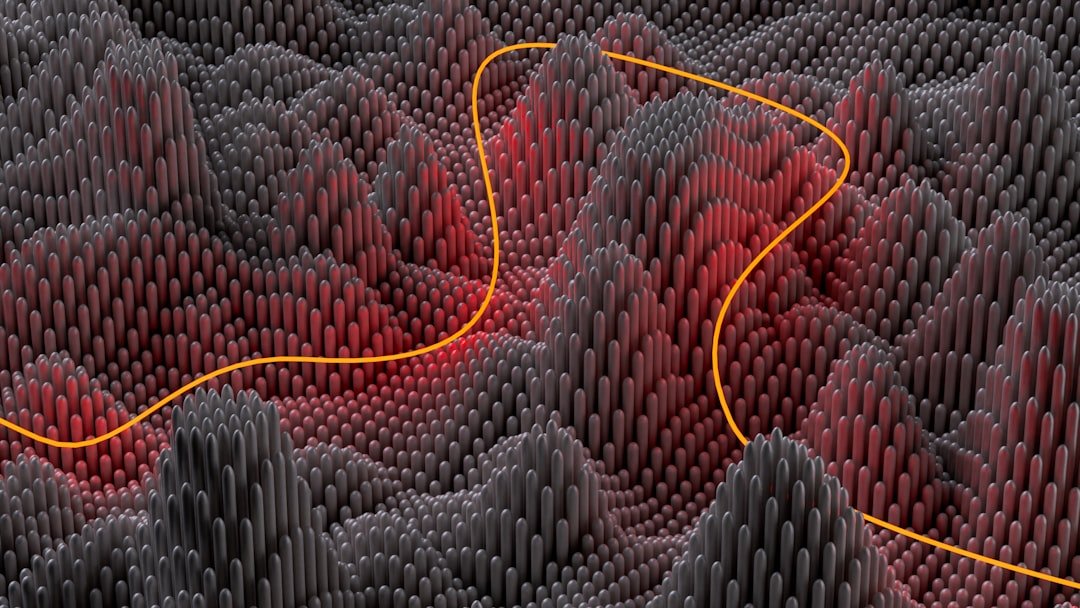

To overcome this hurdle, central banks must work collaboratively with financial institutions to integrate CBDCs into existing systems rather than positioning them as direct competitors. Additionally, technological infrastructure will play a pivotal role in determining the success of CBDC implementation. Ensuring that adequate systems are in place to support widespread usage is essential; this includes addressing issues related to scalability and interoperability with existing payment networks.

Moreover, public trust in digital currencies will be critical; if consumers perceive CBDCs as unreliable or insecure, adoption rates may suffer significantly. Conversely, these challenges also present opportunities for innovation within the consumer market. The introduction of CBDCs could spur new business models focused on digital finance solutions tailored to meet consumer needs.

Fintech companies may emerge as key players in developing applications that enhance user experiences with CBDCs or provide additional services such as budgeting tools or investment platforms linked directly to digital currencies.

The Future of Central Bank Digital Currencies in the Consumer Market

As central banks continue to explore the potential of CBDCs, their impact on the consumer market will likely be profound and multifaceted. The evolution of digital currencies presents an opportunity to reshape how individuals interact with money while addressing longstanding issues related to financial inclusion and accessibility. However, navigating the complexities associated with consumer protection, privacy concerns, regulatory frameworks, and technological infrastructure will be essential for realizing these benefits fully.

The future landscape of finance may very well be defined by how effectively central banks can implement CBDCs while fostering an environment conducive to innovation and consumer trust. As we move forward into this new era of digital finance, it will be crucial for all stakeholders—governments, financial institutions, technology providers, and consumers—to engage collaboratively in shaping a system that meets the needs of society at large while ensuring stability and security within the financial ecosystem.

FAQs

What are central bank digital currencies (CBDCs)?

Central bank digital currencies (CBDCs) are digital forms of a country’s fiat currency that are issued and regulated by the central bank. They are different from cryptocurrencies like Bitcoin, as they are backed by the government and have legal tender status.

How do central bank digital currencies enter consumer markets?

Central bank digital currencies can enter consumer markets through various channels, such as commercial banks, digital wallets, and payment service providers. Consumers can access and use CBDCs for everyday transactions, similar to physical cash or electronic payments.

What are the potential benefits of central bank digital currencies for consumers?

Potential benefits of central bank digital currencies for consumers include increased financial inclusion, lower transaction costs, enhanced payment efficiency, and improved access to secure and reliable payment methods.

What are the potential risks or challenges associated with central bank digital currencies entering consumer markets?

Potential risks or challenges associated with central bank digital currencies entering consumer markets include concerns about privacy and data security, potential impact on traditional banking systems, and the need for robust regulatory frameworks to mitigate risks such as money laundering and fraud.

Are central bank digital currencies already in use in consumer markets?

While some countries have been exploring the development and implementation of central bank digital currencies, they are not yet widely in use in consumer markets. However, several central banks are conducting research and pilot programs to assess the feasibility and implications of CBDCs for consumers.